Preferred Credit Union has become a popular choice for individuals seeking reliable financial services that prioritize member satisfaction and community support. Whether you're looking for loans, savings accounts, or other banking solutions, Preferred Credit Union stands out as a trusted institution. This article will explore everything you need to know about Preferred Credit Union, from its history to the benefits of becoming a member.

Financial institutions play a critical role in shaping our financial well-being. Among the many options available, credit unions have gained recognition for their member-focused approach. Preferred Credit Union, in particular, has carved out a niche by offering personalized services and competitive rates.

In this comprehensive guide, we will delve into the world of Preferred Credit Union, highlighting its services, advantages, and how it compares to traditional banks. By the end of this article, you'll have all the information you need to decide whether Preferred Credit Union is the right choice for your financial needs.

Read also:Shaker Woods Festival A Celebration Of Music Nature And Community

Table of Contents

- The History of Preferred Credit Union

- How to Become a Member of Preferred Credit Union

- Services Offered by Preferred Credit Union

- Advantages of Joining Preferred Credit Union

- Fees and Charges at Preferred Credit Union

- Loan Options Available at Preferred Credit Union

- Savings Accounts at Preferred Credit Union

- Preferred Credit Union vs Traditional Banks

- Digital Banking Technology at Preferred Credit Union

- Community Involvement of Preferred Credit Union

The History of Preferred Credit Union

Preferred Credit Union was established with a vision to provide affordable financial services to the community. Since its inception, it has grown into a prominent financial institution, serving thousands of members across various regions. The credit union's commitment to transparency and member satisfaction has earned it a reputation as a trusted financial partner.

Over the years, Preferred Credit Union has expanded its offerings to include a wide range of products and services. From traditional savings accounts to advanced digital banking solutions, the credit union continues to adapt to the evolving needs of its members.

As a not-for-profit organization, Preferred Credit Union reinvests its profits back into the community, ensuring that members receive the best possible value. This dedication to community development sets it apart from traditional banks that prioritize shareholder interests.

How to Become a Member of Preferred Credit Union

Becoming a member of Preferred Credit Union is a straightforward process. To join, you need to meet the eligibility criteria, which typically includes residing or working within the credit union's designated service area. Once you qualify, you can apply online or in person at one of their branches.

Eligibility Requirements

- Live, work, worship, or attend school in the credit union's service area

- Be a family member of an existing member

- Join a partner organization affiliated with Preferred Credit Union

After fulfilling the eligibility requirements, you can open a membership account by depositing a nominal amount. This initial deposit serves as your share in the credit union and grants you access to all its services.

Services Offered by Preferred Credit Union

Preferred Credit Union offers a diverse array of financial products and services designed to meet the needs of its members. Below are some of the key services provided:

Read also:Exploring The Golden Fruit Garden A Paradise Of Exotic Flavors

Core Services

- Savings accounts with competitive interest rates

- Checking accounts with no hidden fees

- Personal loans and auto loans at affordable rates

- Mortgage loans for homebuyers

- Credit cards with cashback and rewards

In addition to these core services, Preferred Credit Union also offers specialized products such as youth savings accounts, retirement planning services, and financial education programs. These offerings ensure that members have access to comprehensive financial solutions tailored to their unique needs.

Advantages of Joining Preferred Credit Union

Joining Preferred Credit Union comes with numerous benefits that make it an attractive option for individuals seeking reliable financial services. Below are some of the key advantages:

Member-Focused Approach

- Lower fees compared to traditional banks

- Higher interest rates on savings accounts

- Personalized customer service

- Community-focused initiatives

As a member-owned institution, Preferred Credit Union prioritizes the needs of its members over profit generation. This commitment to member satisfaction ensures that you receive the best possible value for your financial transactions.

Fees and Charges at Preferred Credit Union

Preferred Credit Union strives to minimize fees and charges for its members. While some services may incur nominal fees, the credit union is transparent about its pricing structure, ensuring that members are fully informed.

Common Fees

- Overdraft fees for checking accounts

- ATM withdrawal fees outside the credit union's network

- Loan processing fees

Members can avoid many of these fees by maintaining minimum balances or utilizing the credit union's digital banking services. Additionally, Preferred Credit Union frequently offers promotions and discounts to help members save money.

Loan Options Available at Preferred Credit Union

Preferred Credit Union provides a wide range of loan options to help members achieve their financial goals. Whether you're purchasing a vehicle, financing a home, or consolidating debt, the credit union has a loan product to suit your needs.

Popular Loan Products

- Personal loans with flexible repayment terms

- Auto loans with competitive interest rates

- Mortgage loans for first-time homebuyers

- Debt consolidation loans to simplify payments

Members can apply for loans online or in person, with quick approval processes and personalized support from experienced loan officers. These features make Preferred Credit Union an ideal choice for those seeking affordable financing solutions.

Savings Accounts at Preferred Credit Union

Savings accounts at Preferred Credit Union are designed to help members grow their wealth while maintaining liquidity. The credit union offers several types of savings accounts, each with its own benefits and features.

Types of Savings Accounts

- Regular savings accounts with competitive interest rates

- Money market accounts for higher balances

- Certificates of deposit (CDs) with fixed terms

- Individual retirement accounts (IRAs) for long-term savings

With no hidden fees and easy access to funds, Preferred Credit Union's savings accounts provide a secure and rewarding way to build your financial future.

Preferred Credit Union vs Traditional Banks

When comparing Preferred Credit Union to traditional banks, several key differences emerge that highlight the credit union's unique advantages. Below are some of the main distinctions:

Key Differences

- Lower fees and higher interest rates

- Member-focused governance structure

- Community-oriented initiatives

- Personalized customer service

While traditional banks may offer a broader range of services, Preferred Credit Union excels in providing tailored solutions that prioritize member satisfaction. This focus on community and service makes it an excellent choice for those seeking a more personalized banking experience.

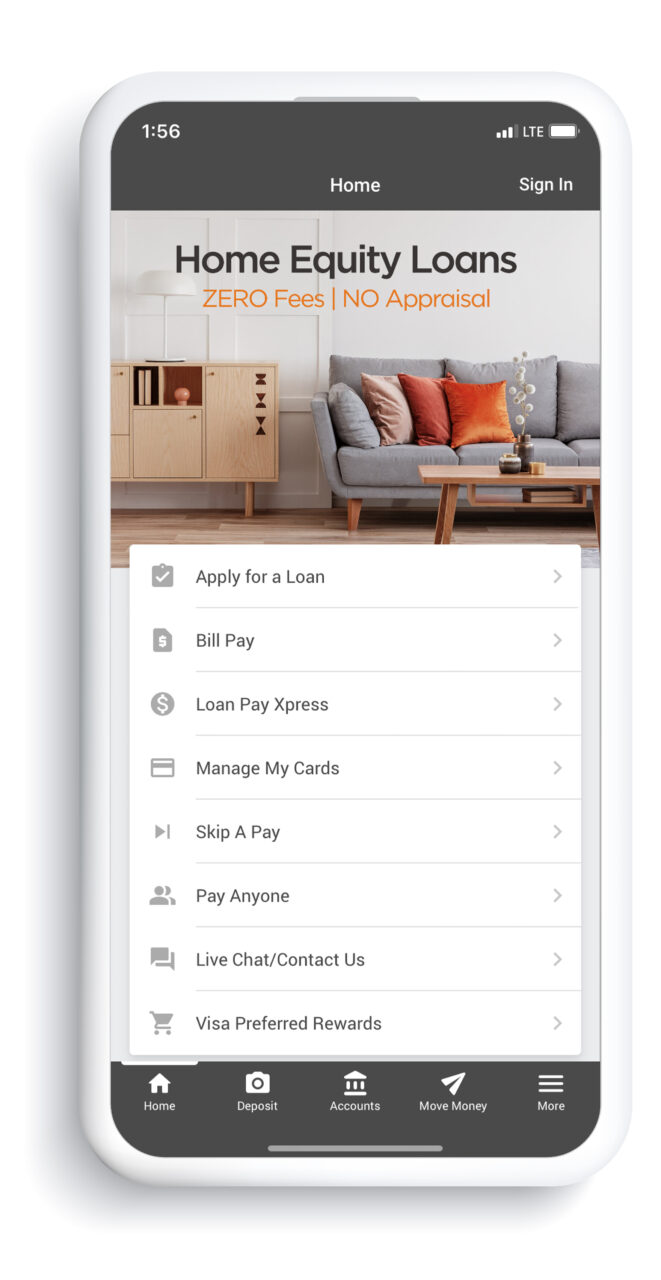

Digital Banking Technology at Preferred Credit Union

Preferred Credit Union embraces cutting-edge technology to enhance the member experience. Through its digital banking platform, members can access their accounts, make transactions, and manage their finances from the convenience of their devices.

Features of Digital Banking

- Mobile banking app with real-time account updates

- Online bill pay and person-to-person payments

- Mobile check deposit for seamless transactions

- Security features such as multi-factor authentication

By leveraging technology, Preferred Credit Union ensures that members have access to their accounts anytime, anywhere, while maintaining the highest standards of security and privacy.

Community Involvement of Preferred Credit Union

Preferred Credit Union is deeply committed to giving back to the communities it serves. Through various initiatives and partnerships, the credit union supports local organizations and promotes financial literacy.

Community Programs

- Financial education workshops for adults and youth

- Partnerships with local charities and non-profits

- Annual community outreach events

- Scholarship programs for aspiring students

By investing in the community, Preferred Credit Union reinforces its mission to empower individuals and promote economic well-being. This commitment to social responsibility further strengthens its position as a trusted financial institution.

Kesimpulan

Preferred Credit Union stands out as a premier financial institution that prioritizes member satisfaction and community development. With its wide range of services, competitive rates, and personalized customer service, it offers a compelling alternative to traditional banks. Whether you're looking for savings accounts, loans, or digital banking solutions, Preferred Credit Union has everything you need to achieve financial success.

We encourage you to explore the benefits of becoming a member of Preferred Credit Union and take advantage of the many services it provides. Share your thoughts in the comments below, and don't forget to check out other informative articles on our website for more insights into the world of finance.

Data sources: Preferred Credit Union Website, Credit Union National Association, Federal Deposit Insurance Corporation